Last week, I shared the three pillars I lean on when it comes to life. Wealth is a particular area I’ve found myself invested in as of late. Personal finance has long been an area of interest, especially this one particular area, financial independence.

Discovering FIRE

I first learned about the financial independence, early retirement movement, or FIRE as the cool kids call it these days, through Mr. Money Mustache. His blog was a huge inspiration to start my own, as well as a hefty amount of trials since the beginning.

Admittedly, I was lucky that I found myself with a decent base after graduating college. I had a fairly good salary and I lived in a cheap city. After finding the blog, I was amped to turn things up to the next level.

Learning more and changing my perspective on a lot of things seemed a lot easier than working for another 50 years. I happily embraced many of his practices, such as biking or walking to destination, reading more, and even trying to DIY solutions to my problems.

Losing the Spark

At the beginning of this year, I found myself starting a new job. With this change, I was luckily to be making a bit more money. Unfortunately, I didn’t take the opportunity as well as I could have. Rather than maintain my already comfortable lifestyle I bought some “upgrades” and let myself start slacking off.

There would be months I didn’t pay attention to my finances at all. Instead of investing it or taking a chunk out of my hefty student loan, I lazily kept it around or spent it without thinking.

Getting Back in the Groove

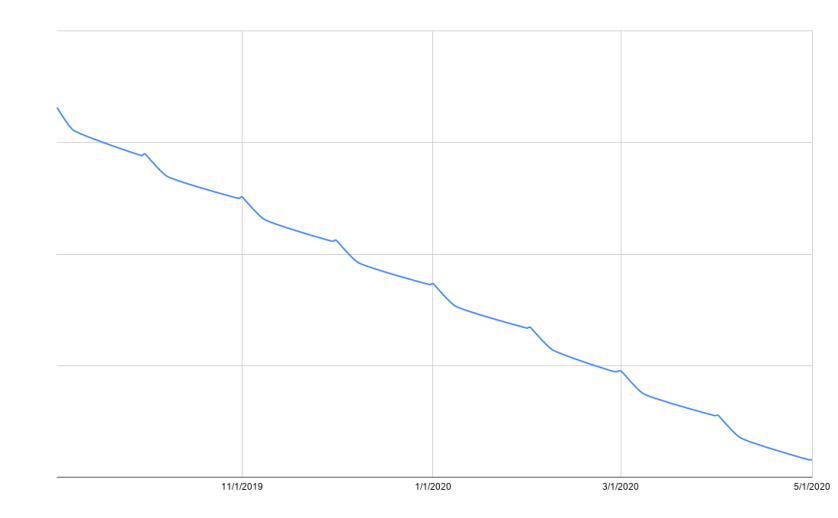

Recently, I’ve been on a huge kick to get my act together. One of the first things I did was determine exactly what I would need to do to pay off my student loan by next May. Seeing $0 in my spreadsheet was one of the most satisfying feeling’s I’ve had in a long time.

To stay on track, I’m busting out some old tools. Mint is probably going to be the biggest one for me. I’m hoping to utilize the budget tool to make sure I stay on track with all of my expenses

These days, instead of looking around for a widget or gizmo to buy when bored, I find myself reading MMM or even the even more intense Early Retirement Extreme. I personally don’t know if I care about the “retire early” piece of FIRE, but having to take money off of the table of worries is certainly something worth pursuing. I’m hoping getting this student loan out of the way opens up the opportunity to take my savings rate to the next level.

One thought on “FIRE at Will”